Construction loan calculator how much can i borrow

How much can I borrow with a personal loan. Compare home loans on Canstars database.

How Much Can I Borrow Home Loan Calculator

That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term.

. In turn you only need to close on the loan once. In comparison with a variable personal loan the interest rate can go up or down at the lenders discretion. To use this calculator simply enter your estimated vehicle value loan term any initial deposit and the amount of any balloon payment a lump sum payment.

Borrowing power calculator - How much can I borrow. Construction 112 Conversion 168 Ecology 27 Everyday life 188 Finance 465 Food 60 Health. The loan amount may be incorrect and problems can arise if you make many variations to the contract.

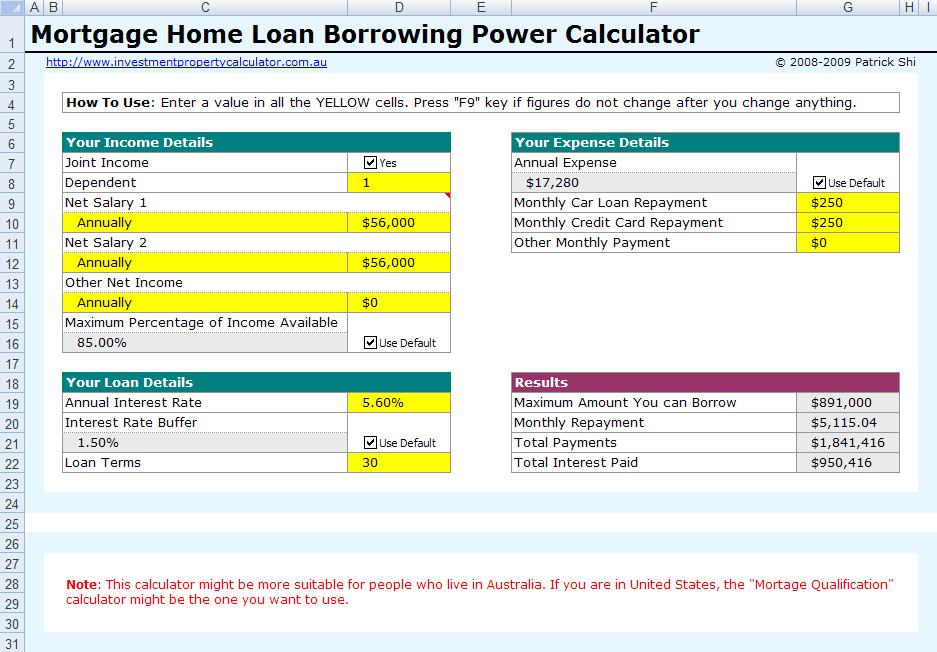

When you get a credit-builder loan the money you agree to borrow usually between 300 and 1000 is deposited into a bank account in your name but held by the lender. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any. Enter amounts in the fields below and the mortgage calculator will give you your monthly mortgage payment amount.

Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. Construction-only loan A loan to pay for construction costs by disbursing funds in increments as project milestones are met. Find out how to request payments avoid delays.

The payday loan calculator can help you detect and avoid this mishap. You should only borrow as much as you can expect to be able to pay back under the terms of the loanand the interest rate is part of that calculation. All this makes for a tricky landscape.

Pre-qualification is a casual estimate that determines how much money you can borrow for a mortgage. In this example the lender would be willing to offer a loan amount of 171000. This calculator will also tell you how much you may pay in total over the life of your loan.

If a house is valued at 180000 a lender would expect a 9000 deposit. 2 The following loan programs are not eligible for the closing cost credit. Once the house is built you can either repay the loan in full or refinance your construction loan into a new mortgage.

How much can I borrow. When it comes to calculating affordability your income debts and down payment are primary factors. Estimate your taxes and insurance so that these amounts will be included in the payment calculation.

We can help you. With an FHA construction-to-permanent loan you obtain both the construction loan and permanent mortgage at the same time. This is a general estimate not an actual amount.

Construction loans are often set-up with many errors. How Much Are My Payments. For repaying a loan of 1000 at 5 interest for 12 months the equation would be.

How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. Find Out How Much You Can Save With This Calculator. Factors that impact affordability.

If you are seeking a loan for a format without a front. During the home construction process you make interest-only payments on your construction loan. R decimal rate 12.

The comparison tables below display some of the variable rate home loan products on Canstars database with links to lenders websites for borrowers in NSW making principal and interest repayments on a. Expect a lender to ask you about your income assets credit score and existing debts. While your personal savings goals or spending habits can impact your.

This can be used in conjunction with our loan repayment calculator to help you to work out your repayments based on the amount you wish to borrow. While a traditional mortgage also called a permanent loan will help you buy an existing house starting. Monthly payment r r 1r months -1 x principal loan amount.

Construction loans allow landowners to borrow money to build a home from the ground up. Using our calculator above. How Much Can You Afford to Borrow.

This means your repayments may vary over time. Use our car loan calculator as a general guide on what your car loan repayments will look like. The savings can add up over time and total in the thousands depending on the amount borrowed the interest rate of the loan and the term.

This calculator estimates your borrowing power based on your income financial commitments and loan details entered. Determining how much you can save in interest when you make extra payments can be extremely difficult if you attempt to do this by hand. Lenders generally prefer borrowers that offer a significant deposit.

Federal VA FHA Rural Development WHEDA Investment Property and Construction loans. How long will I live in this home. The amount you can borrow from a lender also known as your borrowing power is based on your personal financial circumstances.

The longer term will provide a more affordable monthly. Use our mortgage calculator to determine your monthly payment amount. Rates shown are based on a 235000 loan amount for the purchase of a single family primary residence in Dane County WI with a Loan-to-Value LTV of 75 and a 740 credit score.

Generally has a repayment period of one year or less. Our VA loan affordability calculator gives you an estimate of how much you could afford using a VA home loan based on your financial situation. The loan calculator featured on this page uses the following formula to calculate repayment figures.

With a construction loan your lender will pay your builder directly. They typically request at least 5 deposit based on the value of the property. Our calculator uses information from you about your income monthly expenses and loan term to calculate an estimate of.

A construction loan allows you to borrow money to build a house from the ground up.

Study Loans Education Post Secondary Education Education In India

Home Construction Loan Calculator Casaplorer

Get Best Two Wheeler Loan In Easy Steps Money Lender Personal Loans Loan Interest Rates

Va Loan Pre Approval Process Va Loan Mortgage Loans Mortgage Loan Calculator

Borrow Loan Company Responsive Website Templates Loan Company Wordpress Theme Responsive The Borrowers

Another Monday Another Mortgage Glossary Term Let Us Tell You A Little Bit About Appreciation Appreciati Home Equity Line Of Credit Mortgage Interest Rates

Credit Repair And Credit Score In Erie Pa Tips Tools Credit Repair Business Credit Score Chart Credit Repair

Pin By Lauren Elaine Coleman Photogra On Calculator Calculator Design Get A Loan Loan Calculator

Mortgage Tip Think Long Term Mortgage Refinance Mortgage Federal Credit Union

Borrowing Base What It Is How To Calculate It

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

How Much Can You Borrow For A Mortgage Factory Sale 54 Off Www Ingeniovirtual Com

Making An Offer On A House Below Asking Price In 2022 In 2022 First Home Buyer Home Loans Things To Sell

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

How Much Can I Borrow Home Loan Calculator

Pin On News